How to Simplify Your Massage Therapy Payment Process

- Kyle Cannon

- November 24, 2023

- - Practice management

While your goal may be to provide relaxation to your clients, behind the scenes, you might be feeling overwhelmed by the complexities of payment processing. Plus, it can be difficult to provide great massage therapy if you’re feeling the strain of juggling cash, cards, apps, and more in your practice.

Luckily, there are ways to smooth out the massage therapy payment process, and we’re here to guide you through that. In this guide, we’ll cover the following topics:

- Popular ways to accept massage therapy payments

- Digital payment processing for massage therapists

- Choosing the right massage therapy payment processor

- Our top massage therapy payment processor picks

With a seamless payment process, you’ll make running your business less stressful for yourself. And, you’ll create a more streamlined payment experience for your customers, making them more likely to book appointments and build stronger relationships for your massage practice. It’s a win-win!

Popular ways to accept massage therapy payments

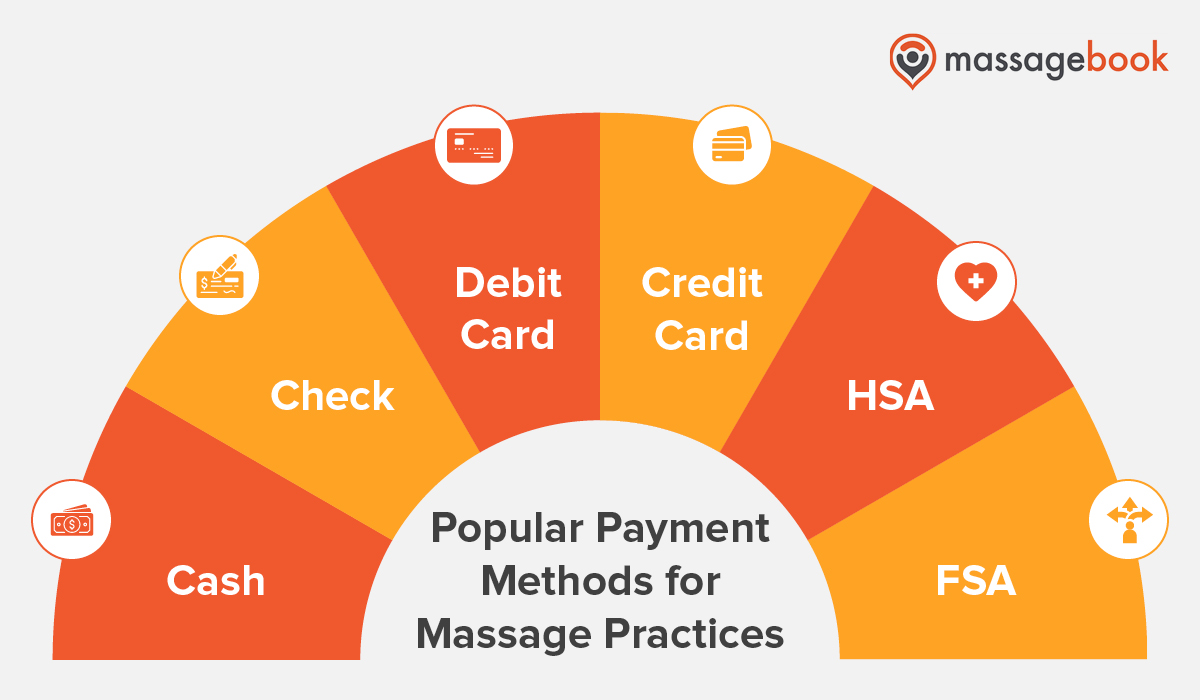

Much like other businesses, massage practices often accept a variety of payment methods. Some of the most commonly accepted massage therapy payment methods include:

- Cash

- Check

- Debit card

- Credit card

- Health Savings Account (HSA)

- Flexible Spending Account (FSA)

While versatility allows you to accept payments according to client preference, it’s not the most sustainable option. As your practice grows, you’ll be accepting many more payments. If all of these payments come from different sources, then you’ll have a lot of extra administrative footwork you need to do to track your finances.

Digital payment processing for massage therapists

In recent years, the trend of accepting contactless payment has grown, with clients choosing to forego cash for convenient tap-and-go options. That’s where digital payment processing comes in. Also known as electronic payments, it refers to the transfer of currency from one account to another using digital payment technologies, such as mobile wallets or mobile payment apps.

Popular digital payment processing platforms for massage therapists include:

It’s tempting to accept payments on all of these platforms—after all, your customers might prefer to use different platforms. However, these payment processors all have their own transaction and withdrawal fees, so you might lose money if you use all payment processors. That means the best option is to invest in one processor and use it for all payments.

Choosing the right massage therapy payment processor

Choosing a single payment processor is an important decision to make, but it can feel daunting if your massage practice currently accepts various payment methods. To help you choose a solution that best fits your massage business, keep in mind the following aspects:

-

Client preferences. Unless you’re just starting your massage business, you likely have an idea of how your clients prefer to pay for their massage sessions. For example, if the majority of your clients like to Venmo you, keep that in mind during your search.

-

Fees. One of the most important features you must evaluate when deciding on your digital payment processor is the platform’s fees, such as transaction fees and withdrawal fees. For example, Venmo charges businesses a fee of 1.9% + $0.10 for payments sent from another Venmo account. For contactless payments, the rate increases to 2.29% + $0.10.

-

Versatility. Some payment processors allow you to accept payments through various methods. For example, Square allows you to accept payments made in person through credit and debit cards in addition to mobile payments. You can also accept online payments. Choosing a versatile payment processor gives your clients more flexibility, even though you’re using a single solution.

-

Security. It’s crucial to offer your customers a safe payment experience. Protecting sensitive payment information and complying with industry standards secures your clients’ trust. Look for a payment processor that meets the Payment Card Industry Data Security Standard (PCI DSS) to stay in compliance with industry standards.

-

Integrations. Running a massage business requires much more work than merely accepting and tracking finances. It also requires you to take comprehensive client notes, send targeted marketing messages, and more. If you use other software solutions to help you do that, keep an eye out for payment processors that integrate with your existing tools and website.

-

Customer service. You’ll inevitably run into issues with your payment processor. To minimize the headache of the situation, be sure that the processor you choose provides great customer service. That way, they can answer your questions and get you up and running again with minimal impact on your business.

An integrated payment solution will create a secure, reliable channel for all your payments to flow through. They will consolidate transactions, minimize errors, and save your business time. Plus, offering mobile payment solutions gives your practice a professional edge, as more and more individuals wish to pay through mobile.

Our top massage therapy payment processor picks

Now that you know why you should choose a digital payment processor, let’s take a look at the top payment processors.

Stripe

Stripe offers a fully integrated suite of financial and payment products that help you reduce costs, grow revenue, and run your business more efficiently. Through their solutions, you can optimize your checkout conversion and offer local payment methods that suit your clients. Some of the features they offer include:

-

Invoicing. Generate invoices with Stripe’s built-in feature for your massage patients within minutes to collect revenue faster.

-

Pre-built checkout forms. With Stripe, you won’t have to worry about creating checkout or payment forms. This solution has pre-built conversion-optimized forms that you can easily implement on your website.

-

Security compliance. This payment processor is PCI-compliant and allows for the storage, encryption, decryption, and transmission of card data to ensure a safe payment experience for clients.

-

Flexible in-person payments. With Stripe’s hardware, clients can dip, swipe, or tap their cards to make a payment, allowing for greater flexibility and convenience. If you’re using MassageBook’s software, you won’t need Stripe’s hardware—with just your phone, you can use our mobile app as a contactless card reader, powered by Stripe Tap to Pay.

-

Robust customer support. Stripe offers 24/7 phone, chat, and email support to ensure that you can use and implement their tools successfully. And, here at MassageBook, our support team can directly assist you with any payment issues within the platform, unlike with other providers.

Stripe has no setup fees or monthly fees. Instead, it charges 2.9% + $0.30 per successful card charge. If you’re using the MassageBook-Stripe integration, you’ll pay 2.75% per card-present transaction and 2.9% + $0.30 per card-not-present transaction.

Square

Square Payments is one of the most commonly used payment processors because of the convenience it offers both businesses and their customers. A few of their standout features include:

-

In-person and online payments. Square empowers you to accept both in-person and online payments, allowing you to flexibly accept payment for bookings.

-

Contactless mobile payments. For massage therapists who do intake calls, Square allows you to use your mobile phone to accept payments through tap to pay.

-

Instant transfers. Move money to your external bank account instantly for a 1.75% fee. Or, set up automatic transfers to ensure you can access your funds.

-

PCI compliance. Square provides fraud protection, data security, and dispute management so that you’re protected when you take payments. Plus, it’s also PCI compliant so clients are protected, too.

Square charges different transaction fees depending on where and how the transaction was conducted. In-person payments have a transaction fee of 2.6% + $0.10, whereas online transaction fees are 2.9% + $0.30. If you’re using the MassageBook-Square integration, you’ll pay 2.6% + $0.10 per card-present transaction and 3.5% + $0.15 per card-not-present transaction.

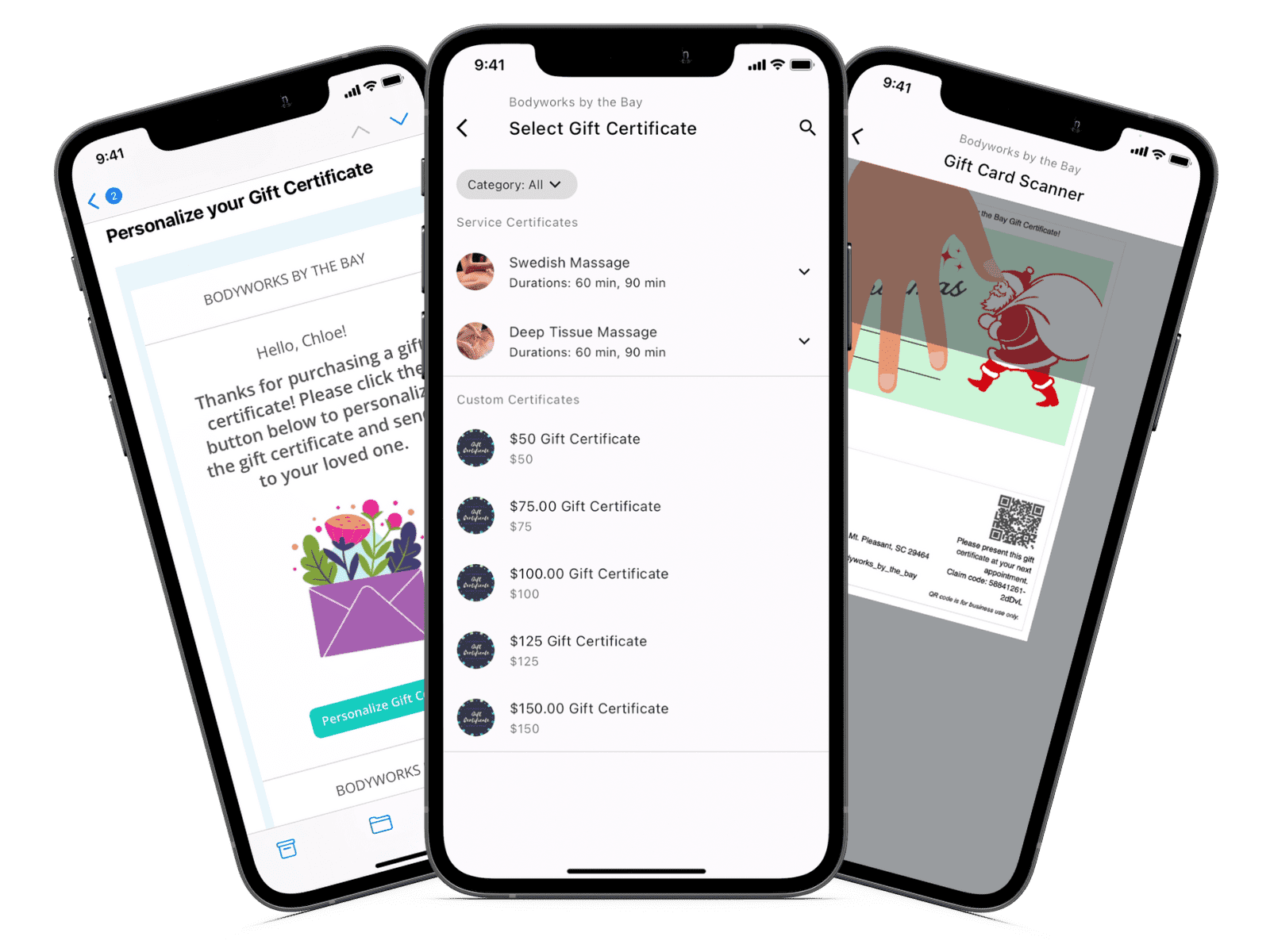

The best aspect of these two payment processors is that they fully integrate with MassageBook’s software and other similar solutions. With these integrations, you’ll be able to easily record and access the complete payment history of every client and gain insights into your growth. And, after payment is complete, you can easily send appointment reminders so clients remember their bookings. These features will help you sustainably grow your practice.

Additional resources

The payment processing industry is constantly evolving, presenting better solutions to create more positive experiences for customers. Your practice needs to stay ahead of the game and be ready to adapt. Whether it’s embracing the next big thing in secure payments or tailoring your services to match shifting consumer trends, keeping your finger on the pulse of the industry will only help you to grow and succeed. If you’re interested in learning more about running a massage therapy practice, check out these additional resources:

- 7 Best Massage Therapy Software Solutions for 2023 — Aside from payment processors, massage therapy software can also streamline your practice’s operations. Read about the top solutions in this article.

- A Guide to Massage Billing: Insurance Codes for Therapists — Did you know you can accept medical insurance for your billing purposes? Learn more about the pros and cons of insurance for massage billing in this guide.

- Marketing Massage Therapy: 7 Effective Techniques to Explore — Marketing your massage business can be a daunting task. We’ll help you get more familiar by exploring seven marketing techniques you can incorporate.

- Author: Kyle Cannon

- Published: November 24, 2023

Grow and simplify your practice!

Related Posts

Recent Blog Posts

Categories

Categories Index ( 21 )

- Friday focus (9)

- Massage therapists (42)

- Massage therapy benefits (7)

- Marketing (157)

- Massagebook features (12)

- Healthy living (12)

- Press (2)

- Practice management (55)

- From our ceo (3)

- Software releases (23)

- Education (5)

- People focus (3)

- Types of therapy (1)

- Uncategorized (1)

- Massagebook (36)

- Massage therapy (4)

- Massage practice (1)

- Massagebook (1)

- Fun (1)

- Guest blog (1)

- Resources (2)

.png)