Bookkeeping may not be the most fun part of a massage therapist’s job, but it is paramount to growing (and sustaining) a healthy small business. We have spoken with many of our massage professional clients who have had issues in the past, so we wanted to compile a list of common mistakes to avoid.

While the task looms large, our biggest piece of advice is simple: get—and stay—organized throughout the year. Creating recording habits early ensures a smoother tax season and budget planning season each year. Think of it as your headache prevention, and there’s no better time to start than in the new year!

Also remember: there is no such thing as too much information when it comes to income, expenses, barters, and tax deductions. So if you have a question of whether or not to keep that receipt or log that service donation, just do it!

Now, on to the list of bookkeeping mistakes massage therapists should avoid:

1. Not keeping thorough records throughout the year

The importance of keeping thorough records cannot be overstated, but it’s often the last thing on our minds. Playing catch-up once a week/month/quarter is stress-inducing, so we’ve come up with a few small ways to ensure good habits are created.

You probably already record daily sales in a sales journal, but adding your cash receipts to the same journal can save you time and eliminate keeping up with multiple places to input data. If you’re preparing recurring invoices or anything aside from receipts, be sure that each copy (retained by you and your client) has:

-

Payment due date

-

Quantity & price

-

The date of sale

2. Not keeping receipts for potential deductions

If you’re not familiar with tax deductions, it’s essentially a way for a business to lower its taxable income by deducting regular business expenses. For example, you may be able to deduct the $2,000 you spent this year on items like creams, oils, lotions, towels, warming equipment, hot stones, or a new table. Things like power, water, and internet services are also legitimate costs of doing business.

You may not always have time to do the research on whether or not a business expense can count toward a deduction on your taxes, so it’s important to keep receipts from anything you might consider writing off. If the expense is related to your business, “ordinary,” and “necessary,” it’s likely to qualify.

Some common examples of deductions for independent massage therapists include:

-

Office supplies & cleaning services

-

Massage supplies

-

Consulting fees

-

Magazine/periodical subscriptions

-

Client gifts

-

Mortgage/rent

-

Uniforms

-

Continued education

You can learn more about common deductions from AMTA.

3. Not tracking bartered services

For some small businesses, bartering is a great way to get things done while still maintaining cash flow. For example, you might trade massage services for business consulting or marketing help. The IRS still counts bartering dollars as regular dollars, so it’s important to keep track of these exchanges.

You can file this bartering income on a 1040, 1099-MISC or 1099-B form come tax time, but it depends on whether it was a service-only trade or a goods and services trade. Therefore, we recommend consulting a professional tax accountant so that you don’t end up having to revise your return.

4. Doing everything yourself

When you open, your bookkeeping may stay fairly straightforward. You’ve kept your receipts, you’ve created good recording habits, and you have a tax professional you can consult with if you have any questions.

However, your business’s finances could get more complicated if, for example, you sublet or rent space to another practitioner, barter/trade services for goods, employ a team, travel often for work, accept investments, or enter a business partnership. Just like in life, if you find yourself in over your head with your bookkeeping, we suggest asking for help!

5. Not investing in automation or software

If you’d rather keep your massage therapy business’s bookkeeping in-house, seeking ways to automate the process can make your life a lot easier. Paper requires keeping multiple copies of documents/receipts/invoices and a filing cabinet in which to store them. Digital keeps it all on-hand from virtually every device you own, and you can find things without having to search a bunch of paper files.

If you’re looking to commit to a paperless massage therapy practice in the future, we suggest starting small. Digital receipts and online payments are a more convenient way for your customers to pay. Then you can tackle things like scanning your old paper receipts with a program like Shoeboxed.

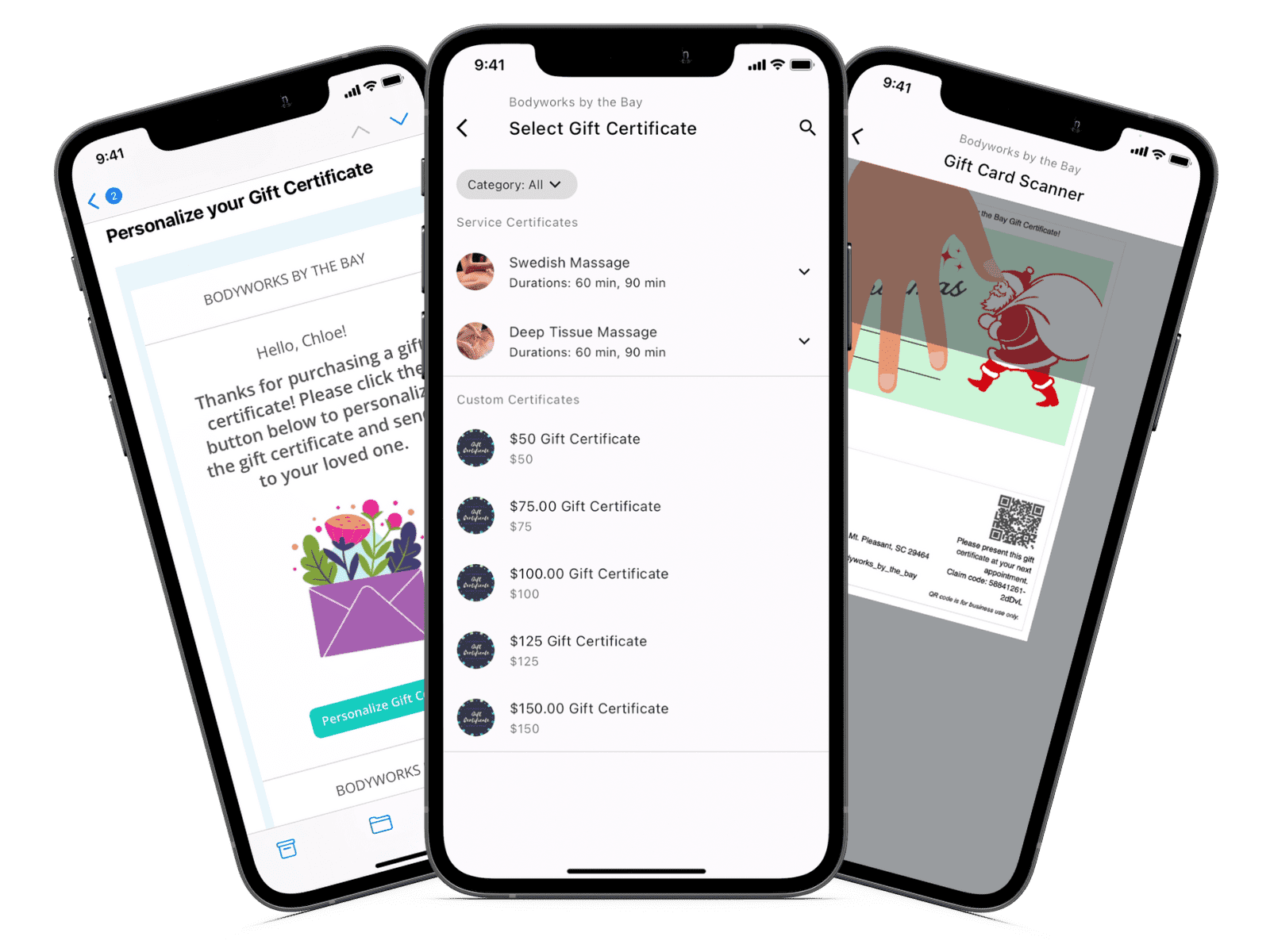

Heck, at MassageBook, bookkeeping just happens. We keep track of all your sales activity with detailed reports, and you can start accepting online payments in minutes with our seamless credit card processing integration.

If you have been running your independent massage therapy business for years with paper, and you’re nervous to take on the task of going digital, let us reassure you: it may take some time and commitment, but it will be worth it in the end!

6. Failing to properly classify employees

Another common bookkeeping mistake for massage therapists is not properly classifying individuals on your team. Employees generally fall into one of three categories: full-time, part-time, or temporary.

Depending on the state where you operate your business, you will have several matters to consider with each of these categories, including workers’ compensation, unemployment compensation, unpaid family leave, or medical leave. These are all mandated and are different from what you choose to pay and the benefits you offer.

The danger of failing to properly classify employees when it comes to your bookkeeping is a big one: a small business audit. It’s simply a big red flag to the IRS. So it’s important to read up on exempt and non-exempt status, as well as what’s required for part-time and/or independent contractors. To learn more on classifying employees, read this from Bookkeeper.com.

7. Failing to reconcile books with your bank statements

Data entry is no one’s favorite task, and no matter how meticulous you are, there is always room for human error. That’s why it’s so important to reconcile your books with your bank statements. This allows you to account for any irregularities, duplicates, or errors.

This may sound like a simple task, but if you only do it once a month, it can take longer. That’s why we recommend trying to block time to do this every week. Bonus: it will keep you alerted if there are any fraudulent transactions or issues with your bank account!

8. Not knowing when to work with a professional

Let’s say you’ve taken all this advice: you’re keeping every receipt for potential deductions, you’ve gone digital, you’ve done your research on employees, and everything else in between. But you’re still sitting hunched over a desk for hours on end and not able to catch your breath. It might be time to hire a professional.

The pandemic has shown us that you don’t always need an in-house employee, so it could be easy to hire someone part-time to stay on top of all your bookkeeping—someone to regulate the invoices, manage the payroll, and ensure rent is always on time.

Bottom line: if you can take the time they save you to accept more massage clients (or to spend more time with your family), then it’s a worthwhile investment!

What, if anything, have you learned? Have you taken some of this advice and plan to implement it in 2021? We’d love to hear from you about your bookkeeping woes and wins on the MassageBook Facebook page.

Need help managing your business? Try our business software for massage professionals for free!

- Author: Zack Hanebrink

- Published: January 22, 2021

Grow and simplify your practice!

Related Posts

Recent Blog Posts

Categories

Categories Index ( 21 )

- Friday focus (9)

- Massage therapists (42)

- Massage therapy benefits (7)

- Marketing (157)

- Massagebook features (12)

- Healthy living (12)

- Press (2)

- Practice management (55)

- From our ceo (3)

- Software releases (23)

- Education (5)

- People focus (3)

- Types of therapy (1)

- Uncategorized (1)

- Massagebook (36)

- Massage therapy (4)

- Massage practice (1)

- Massagebook (1)

- Fun (1)

- Guest blog (1)

- Resources (2)