Tips to Help Massage Therapists Simplify Tax Season

- Amber Ludeman

- February 06, 2023

- - Practice management

As a massage therapist, you’re an expert at helping others relieve stress, but tax season can bring on its own set of headaches. Filing taxes can be daunting. And that’s especially true if you’re just starting your massage practice and have never handled taxes for a business before. The good news is that you don’t have to tackle this alone. In this article, we’ll provide you with straightforward tips to simplify tax season and help you save time and money. So get ready to breathe a sigh of relief and leave the stress behind!

But before we continue, please note that this article was not written by a tax professional. MassageBook does not intend the information in this article to be official tax advice. Contact a professional tax advisor for more information regarding the specifics of your tax situation.

1. Don’t forget about common tax deductions

First, let’s start with common tax deductions practice owners shouldn’t overlook. You can claim ordinary and necessary operating expenses on your tax return, such as massage equipment, massage supplies, office space utilities, insurance, license fees, and advertising. If you work out of your house or travel to clients, you can even take advantage of deductions related to your home office and car expenses. Just remember to save all receipts associated with doing business.

2. Ask a professional about starting an LLC

If you’re an independent massage therapist, your massage practice isn’t limited to only a sole proprietorship. For example, you can qualify to start a limited liability corporation (LLC). An LLC better protects your personal assets from potential financial and legal liability. Plus, you can cash in on applicable state and federal tax benefits. Please remember, though; it’s vital to seek a tax professional’s help and inquire about what’s best for you before changing your business structure.

3. Fill out the correct IRS tax form

Double-check that you’re filling out the correct form to accurately report your business income and expenses on your tax return. Many small business owners use a sole proprietorship which allows them to report all of their business income and expenses on a Schedule C attachment to their personal income tax return. If you run the business as an LLC and you are the sole owner, the IRS also considers you to be a sole proprietorship that also uses the Schedule C attachment. Multi-member LLCs are considered partnerships and typically file Form 1065. [Source: TurboTax]

4. Explore small business tax credits

The federal government will often issue tax credits to small businesses for engaging in certain activities and initiatives, such as updating their location to accommodate people with disabilities and using alternative energy. Knowing whether or not you qualify is essential, as it can help reduce your tax liability on a dollar-for-dollar basis.

5. Know when to file for an extension

Although mid-April is at the forefront of every business owner’s mind regarding tax deadlines, you can also file for an extension before that deadline. There are a few reasons to do this, such as avoiding tax preparation fees, avoiding penalties, and improving the accuracy of your tax paperwork. However, this does not extend the deadline to pay taxes. You may be subject to penalties and interest if you fail to pay your tax bill by the original deadline. Therefore, only extend if you are confident you will find more deductions or offset any penalties you may incur.

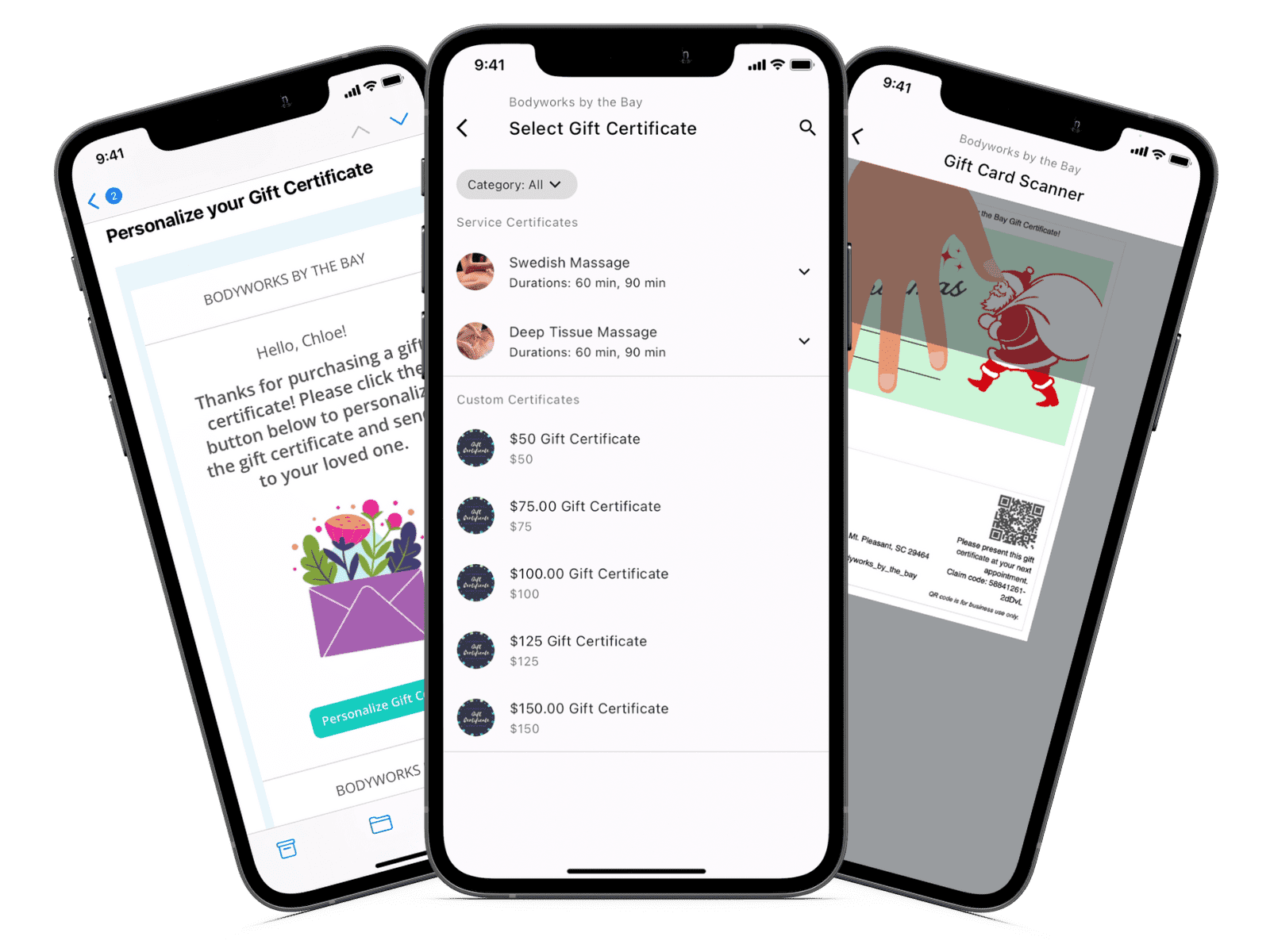

Need help tracking and organizing income for your massage practice? MassageBook’s practice management software makes it easy to:

- Accept card payments via Square or Stripe

- Set up recurring payments for monthly memberships

- Collect tips in person and online

- View and export sales reports

- Include state sales tax in the cost of your services and products

These tools will help you manage your income so that you can do it yourself or hire a tax professional with little to no headaches when it comes time to file your taxes.

Create your free account now to simplify tax season next year

- Author: Amber Ludeman

- Published: February 06, 2023

Grow and simplify your practice!

Related Posts

Recent Blog Posts

Categories

Categories Index ( 21 )

- Friday focus (9)

- Massage therapists (42)

- Massage therapy benefits (7)

- Marketing (157)

- Massagebook features (12)

- Healthy living (12)

- Press (2)

- Practice management (55)

- From our ceo (3)

- Software releases (23)

- Education (5)

- People focus (3)

- Types of therapy (1)

- Uncategorized (1)

- Massagebook (36)

- Massage therapy (4)

- Massage practice (1)

- Massagebook (1)

- Fun (1)

- Guest blog (1)

- Resources (2)